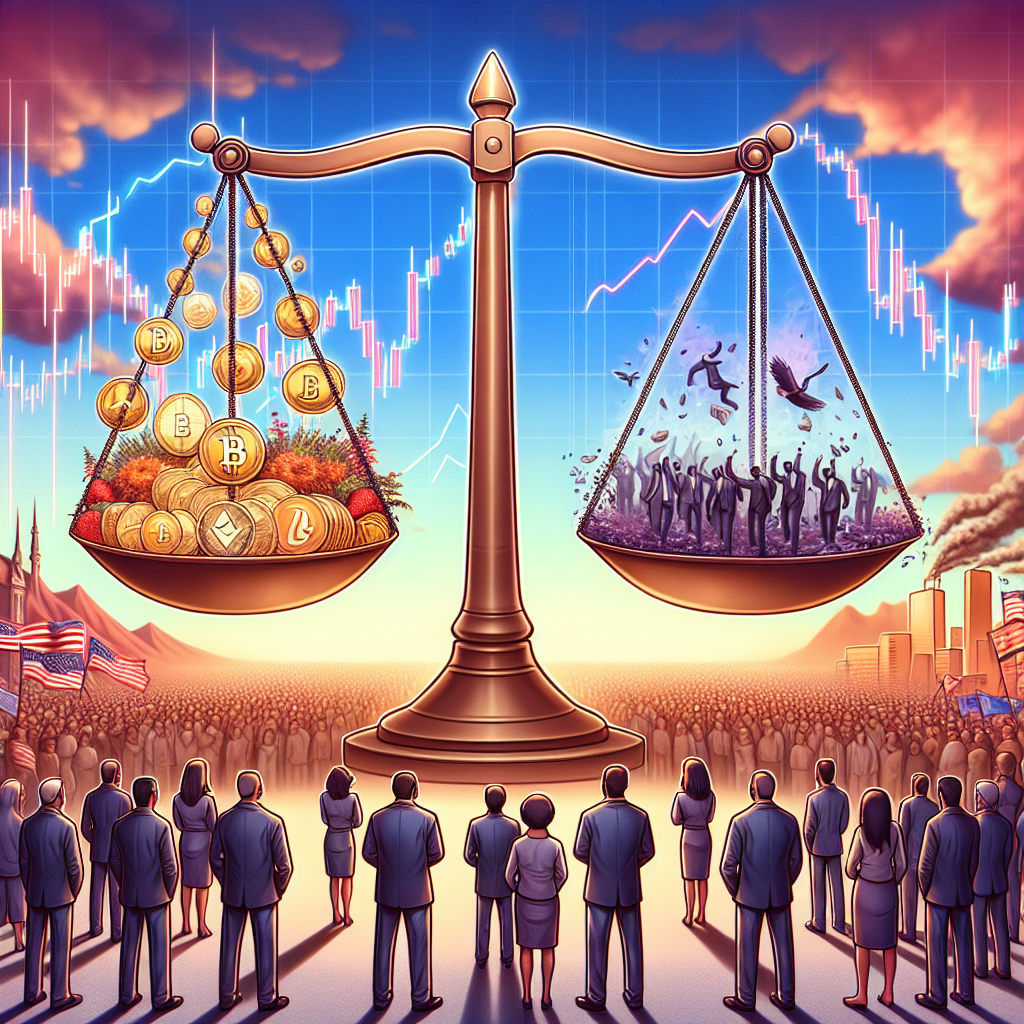

Crypto’s Future Hangs in the Balance: How the Presidential Election Could Reshape Digital Assets

The upcoming US presidential election stands as a pivotal moment for the cryptocurrency ecosystem, with potentially far-reaching consequences for digital asset investors and the broader financial landscape.

Election’s Regulatory Crossroads

The new administration’s approach to cryptocurrency regulation could dramatically alter the industry’s trajectory. A crypto-friendly policy framework could unlock unprecedented growth and investor confidence, while restrictive measures might potentially stifle innovation and market expansion. The tight race between candidates has already introduced significant market uncertainty, with investors cautiously monitoring potential policy shifts.

Market Volatility and Bitcoin’s Uncertain Path

The cryptocurrency market is bracing for potential seismic shifts depending on the election’s outcome. Bitcoin and other digital assets are particularly sensitive to regulatory changes and political sentiment. Investors are strategically holding back, waiting to understand how the new administration will approach digital currencies. Historical trends suggest that major political events can trigger substantial price fluctuations, making this election a critical inflection point for crypto markets.

The implications extend beyond immediate market reactions. The winning candidate’s stance on technological innovation, financial regulation, and blockchain technology will likely set the tone for cryptocurrency’s future in the United States. Key considerations include potential tax treatments, regulatory oversight, and the broader economic policies that could impact digital asset adoption and investment.

Institutional investors and crypto enthusiasts alike are closely watching the election, understanding that the next administration’s policies could either accelerate or potentially hinder the mainstream acceptance of cryptocurrencies. The delicate balance between fostering innovation and protecting consumer interests will be crucial in shaping the regulatory landscape.

As the dust settles on the election, the cryptocurrency industry stands at a critical juncture, with the potential for significant transformation hanging in the balance.